Key Transactions – 2024 Wrap-up

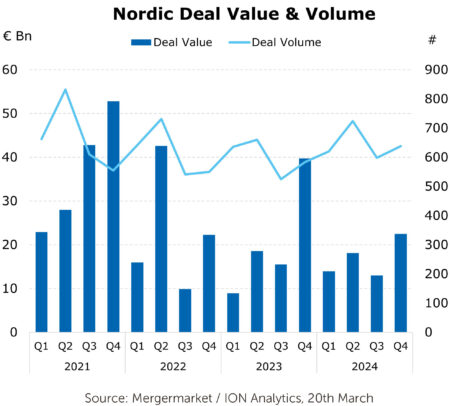

The Nordic M&A market navigated a challenging yet evolving landscape in 2024. High interest rates, inflationary pressures, and geopolitical uncertainties continued to shape investor behaviour and deal-making dynamics. Deal values remained relatively stable in 2024 compared to 2023.

Despite these conditions, our holistic M&A team successfully completed 15 transactions as lead advisor. In terms of overall deal count, Eversheds Sutherland Finland was ranked joint second among the most active M&A advisors in the Finnish market.

These engagements demonstrate the strength of our service model, which combines an owner-driven strategy with deep commercial insight and comprehensive financial and legal expertise.

Looking ahead, we remain moderately optimistic about 2025. With interest rates declining, the financing environment stabilising, and investor confidence gradually returning, the outlook is improving. The Nordic M&A market has proven resilient over time, and we believe that small to mid-sized transactions will continue to drive activity in the region.

Highlights for our 2024 transactions

Öljycenter Finland joins technical trade group

We acted as the legal and financial advisor to the seller in a transaction where Öljycenter Finland, a specialist in industrial lubricants, became part of a group formed by Suomen Kulutusosa and Airfil Oy, under the ownership of Sponsor Capital.

The newly formed group will further merge with Vantaan Kiinnike & Rak Group, creating a significant player in the Finnish technical trade sector. Together, the combined entity generated over €60 million in revenue in 2024.

This transaction strengthens the group’s ability to provide comprehensive services for customers across the built environment sector nationwide.

Hawk Infinity acquires SaaS provider Triplan

We acted as the legal and financial advisor to the shareholders of Triplan Oy, a Finnish SaaS company providing document and case management solutions, with a strong focus on public sector administration.

The entire share capital of Triplan was acquired by Hawk Infinity AS, a Norwegian private equity-backed serial acquirer specialising in enterprise software companies.

We supported our client throughout the multi-phase cross-border process – from early-stage preparations and structuring to negotiation and execution. After a competitive process and intensive negotiations, Hawk Infinity was selected as the buyer.

Labsense Oy sold to Bergman & Beving

We acted as an advisor in a transaction where Swedish publicly listed Bergman & Beving acquired all shares in Labsense Oy.

Labsense, based in Nokia, Finland, is a distributor for several globally leading suppliers of technical laboratory equipment, serving both public and private sector clients in Finland.

Following the acquisition, Labsense will become part of Bergman & Beving’s Division Industrial Equipment, enabling the group to expand into a new niche within the laboratory equipment sector.

Insta Group acquires PLC-Automation Oy

We acted as the buyer’s legal and financial advisor in a transaction where Insta Group acquired the entire share capital of PLC Automation Oy, an engineering and service company.

PLC Automation, with a team of around 30 experts, specialises in automation, electrification, and crane operations. Its services include engineering, software design, commissioning, training, switchgear manufacturing, installation, and crane services.

The acquisition enables the companies to strengthen their specialised competencies close to customers, supporting industrial clients with increasingly diverse electrical automation and digitalisation needs.

Alligo acquires Hämeen & Riihimäen Teollisuuspalvelu

We acted as legal and financial advisors to Hämeen Teollisuuspalvelu Oy and Riihimäen Teollisuuspalvelu Oy in a cross-border transaction in which Swedish publicly listed Alligo acquired the entire share capital of both companies.

Hämeen Teollisuuspalvelu and Riihimäen Teollisuuspalvelu are growing technical wholesale companies offering a broad product range that includes tools, workwear, small machinery, hydraulic services, and contract manufacturing. The companies operate in Southern Finland, serving a diverse customer base.

€29M funding for Aisti Corporation

We acted as the legal and financial advisor to our long-term client, Aisti Corporation, in multiple financing rounds. The most recent €29 million funding package enables a significant manufacturing facility into Kitee, crucial step to the company´s growth journey.

Aisti manufactures patented biodegradable acoustic panels made from wood fiber, offering a sustainable, high-performance, and cost-effective alternative. These panels can seamlessly replace irritating and undesirable mineral wool-based acoustic solutions.

ER-Pahvityö joins Adara Pakkaus

We acted as legal and financial advisor to ER-Pahvityö Oy in a transaction where Adara Pakkaus Oy acquired the company’s entire share capital.

Adara Pakkaus Oy is a long-established family business. ER-Pahvityö, a growing company specialising in cardboard packaging design, production, and sales, operates in the domestic market. The acquisition supports mutual business expansion.

Telatek Service acquired by Auroora Yhtiöt

We acted as legal and financial advisors to Telatek Service in a transaction where Auroora Yhtiöt acquired the entire share capital of the company.

Auroora is a Finnish serial acquirer specialising in water treatment, industrial services, automation, and electrification, with plans to list on the Helsinki Stock Exchange in the future.

Telatek Service provides industrial services including machining for industrial applications, industrial repairs, and large-scale periodic maintenance. The company operates across six sectors, including energy, forest industry, mining, and metal industries.

Multirel partners with Helmet Capital

We acted as Multirel Oy’s legal and financial advisor in a transaction where the company joined forces with Helmet Capital, a Finnish private equity investor focused on mid-sized companies, to accelerate growth.

Multirel provides transformers, compensation devices, electrical equipment, accessories, and related services to energy companies, grid operators, and industries across Finland. The accelerating electrification and energy system transition introduce new challenges—such as decentralized production and fluctuating capacity—driving increased demand for power quality monitoring and management solutions.

Admicom acquires Trackinno Oy

We acted as a financial advisor to Admicom Oyj in transactions where Admicom acquired Trackinno Oy.

Trackinno is a software company focused on developing cloud-based asset management, maintenance, and tracking solutions. Its software is primarily used in the construction, real estate, and industrial sectors, and is accessible via mobile app or web browser.

Through this acquisition, Admicom’s software segment and business operations will be strengthened with new smart functionalities, IoT solutions, partnerships, and growth and internationalisation potential.

Wetteri divests education arm to Professio

We acted as legal and financial advisors to Wetteri in a transaction where it sold its education business—Tieturi Oy and MIF—to Professio, part of Cor Group.

By divesting its Finnish education companies, Wetteri Oyj is streamlining its group structure in line with its strategic focus. The education business will continue under Professio Group, whose core expertise lies in professional training services.

KB Components acquires Plastone

We acted as legal and financial advisors to KB Components AB, a publicly listed specialist supplier of polymer components, in the acquisition of Plastone.

Plastone is a Finnish-Estonian company specialising in plastic injection molding. Through this transaction, KB Components strengthens its production capacity, expands its customer base, and advances its global growth strategy.

Avesco Rent acquires Vatupassi Group

We acted as the sell-side legal and financial advisor in the transaction where Vatupassi Group, a provider of construction measurement and safety equipment as well as rental services, was acquired by Avesco Rent.

Avesco Rent, part of the international Avesco Group, specialises in high-quality equipment rental services. The transaction supports Vatupassi’s long-term development and ensures the continuity of its operations as part of the Avesco Rent Group. The deal streamlines the business structures of both parties while aligning with their strategic objectives.